Russ DeWitt, Editor

President, Capital Adjusters, Inc.

Past President, Nat'l Finance Adjusters

Member:

American Recovery Association

Recovery Specialist Insurance Group

Calif. Assn of Licensed Repossessors

Certified Asset Recovery Specialist

Certified Recovery Agent

____________________________

____________________________

____________________________

REPOSSESSIONS & REMARKETING

Newsletter

First off, what is LPR and how does it work? We are affiliates of the Digital Recognition Network (DRN) and what I describe here is how DRN works. Other LPR companies may administer their information somewhat differently but it is all based on the same basic principle and technology.

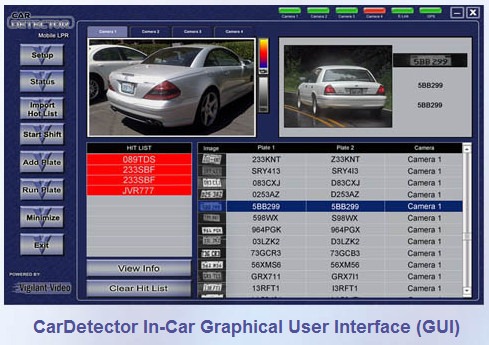

LPR uses specially made, high speed, infrared cameras mounted on cars or trucks that scan license plates as they drive through apartments, businesses and neighborhoods. The software detects the license plate number, takes a picture of the vehicle, a picture of the plate and records its GPS coordinates along with the date and time. This information is instantly uploaded, stored and checked against a local and national database of vehicles out for repossession. If a vehicle is currently out for repossession, one of three things will happen:

It is exciting and rewarding when a vehicle is found and recovered instantly, but probably the most valuable aspect of this technology is building up a large database of vehicles and their locations. We currently have a database of over 2 ½ million license plates. When we receive a new account, one of the first things we do is check the plate against our database and see if, when and where we've ever seen this vehicle before. Many times we are able to find where a debtor has skipped to or hidden the car on the first day we get the account. Or we can be given several addresses for the debtor and see which one is actually current.

When we put any account into our repossession software (we use RDN), it is automatically checked against the entire national DRN database for a match. If it's been "hit" by someone else, DRN puts it through a verification process whereby live people look at the pictures and location to make sure it's the right car, the right plate and state, not at any of the addresses already listed and in a recoverable location like an apartment, business or home (as compared to driving down the road or at a mall, etc.). If it's verified, then we receive notification by email and through RDN, usually within a matter of hours, of the date and time it was spotted and with pictures of the car and its plate, offering the exact location for sale. Additionally, if any vehicle assigned to us is ever scanned in the future by any DRN camera anywhere in the country, we are sent an email notification offering its exact location for sale.

So if we run our client's addresses and the car is not found, we then inform our client that a camera hit is available for sale and that they can purchase the new information. This is a no-risk process because the client only pays for the information if the car is successfully recovered from the purchased address. This can save countless hours in skip tracing and trying to run down this debtor, not to mention the depreciation as the car continues to be used by a debtor who is no longer even paying for his vehicle.

Clients working skips can call us up and ask if we've seen their car recently and if we have, they give us the account right then to pick up. We are contracted with several Buy-Here-Pay-Here dealers who have given us a list of their skipped debtors and the ones we've scanned recently we pick up right away. The others we leave in our system and if one of our cameras later spots it, we pick it up instantly. If any other DRN camera anywhere in the country spots it, we are notified.

(In part two of this series we'll discuss the two main strategies in scanning plates, the drawbacks of LPR and FAQs. In the meantime, if you have any questions about how you can utilize this technology now, feel free to give us a call any time.)

HOW DOES LICENSE PLATE RECOGNITION TECHNOLOGY REALLY WORK?

(Part 1 of a 2 part series)

HOW DOES LICENSE PLATE RECOGNITION TECHNOLOGY REALLY WORK?

License Plate Recognition Technology (LPR) came into being in the repossession industry in 2009. We started using this technology ourselves in 2010. Since then we've learned a lot and are seeing more and more companies coming into being trying to leverage this technology. What I want to do in this two-part series is explain how this technology works in the hopes of enabling you, the collector and lender, to better understand and use this technology.

CAPITAL ADJUSTERS REPORTS

Information on Repossession and Remarketing Issues

Sept 2012